Residential Home Services Merger: A New Era for North American Home Improvement

The merger between Leaf Home and Erie Home marks a significant turning point in the residential services landscape in North America. Combining two well-respected direct-to-consumer home service providers, this strategic move paves the way for a company that not only increases its scale but also broadens its service offering. In this editorial, we take a closer look at the merger, the financing behind it, leadership changes, and what this means for the industry as a whole.

At the heart of this union is a straightforward concept: more is more. When two companies join forces, they can better manage their way through the challenging parts of operation while meeting growing customer demands. But there are also plenty of tricky parts to work through, and industry insiders are watching every twist and turn with great interest.

Evolution of the Residential Home Services Landscape

Over the past decade, North American homeowners have witnessed a dramatic change in how home services are delivered. With consumers increasingly valuing convenience, speed, and quality, companies like Leaf Home and Erie Home have been at the forefront of the evolution from traditional contractor-based services to direct-to-consumer solutions.

Several key trends have shaped this evolution:

- Direct-to-consumer service models: Homeowners now prefer to work directly with service providers, bypassing intermediaries. This change has allowed companies to offer competitive pricing while ensuring quality control.

- Technology-driven customer engagement: Digital platforms have empowered customers with the ability to compare services, read reviews, and request quotes online – making the selection process simpler and more efficient.

- Consolidation and brand strength: As the market becomes more competitive, mergers and acquisitions have become an essential strategy to pool resources and expand geographic reach.

This merger epitomizes the consolidation trend, where companies are not just looking for scale but also for strategic synergy. By combining service lineups like re-roofing, gutter systems, basement waterproofing, and water filtration with home remodeling specialties, the united entity is positioned to serve an ever-growing customer base.

Evaluating the Merger: Strategy and Market Strength

When discussing the nuances of merging two established players, one must consider both the benefits and the challenging bits that come with integrating disparate systems and cultures. Yet, the combination of Leaf Home and Erie Home reflects a carefully thought-out strategy that addresses an array of market demands.

Key aspects of the merged company include:

- Broader Service Spectrum: Now covering metal and asphalt re-roofing, gutter systems, basement waterproofing, water filtration, bath remodeling, stair lift installation, and garage flooring, the new business model provides comprehensive solutions to homeowners.

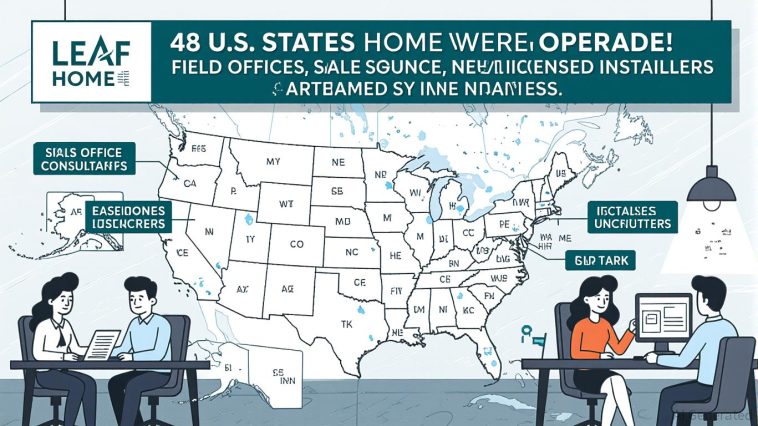

- Geographic Expansion: With operations spanning over 300 field offices in 48 U.S. states and Canada, the scale of service delivery is set to improve dramatically. This ensures that customers from diverse markets will have access to reliable services.

- Direct-to-Consumer Advantage: The merger bolsters the growing trend of bypassing intermediaries. This direct approach not only cuts costs but also allows for better service delivery due to controlled quality and streamlined operations.

The combination is more than just an increase in numbers—it is about building a trusted brand that customers can rely on. The united force is armed with a portfolio that meets both the aesthetic and functional needs of modern homeowners, thereby positioning the company to capture a larger share of the market.

Operational Impact: Expanding Service Offerings and Geographic Reach

The merger brings significant operational enhancements that stretch far beyond consolidation of services. By merging the operational networks of two companies, the new entity can efficiently cover a significantly larger geographic footprint.

Some of the operational highlights include:

- Integrated Field Office Network: Combining over 300 field offices creates a dense network that allows the company to get around local issues efficiently and quickly address customer needs.

- Enhanced Workforce: With more than 3,100 sales consultants and 2,400 licensed installers on board, the company’s capacity to manage multiple jobs simultaneously across various regions is considerably expanded.

- Extended Service Areas: The expanded reach across 48 states and Canada ensures that remote and underserved regions benefit from quality home services that were previously limited to certain areas.

This operational expansion not only translates into more opportunities for revenue, but it also means that the business can better manage its way through complicated pieces of logistics and local regulations. In the end, the improved infrastructure is geared toward delivering increased customer satisfaction and accelerated growth.

Financing and Investment Strategies: Preferred Equity and Debt Partnership

Any major merger of this scale requires a robust financial foundation. In this case, the combined efforts of Ares Management and Apollo played a decisive role in ensuring smooth financing. Ares Management injected preferred equity, while Apollo came in with debt financing. Such sophisticated financing structures are essential for managing the overwhelming parts of large-scale operations.

The advantages of this financial model include:

- Risk Distribution: Balancing the risk between equity and debt provides stability amid the uncertain bits of merging operations. Investors appreciate seeing a balanced approach that controls exposure, ensuring continued support for expansion strategies.

- Access to Capital: With sizable funds from Ares Management and Apollo, the merger is backed by entities with decades of experience in high-stakes investments, reassuring both management and stakeholders.

- Enabling Strategic Expansion: With a deep pool of financial resources, the new company is better positioned to fund further add-on acquisitions and service enhancements, enabling it to maintain a competitive edge in the market.

This approach illustrates how modern deals rely on finely tuned financial instruments to ease the nerve-racking challenges that often accompany change at this scale. The backing by major financial institutions signals confidence in the merger’s long-term success, which bodes well for future stability.

Leadership and Strategic Vision: Profiles of Top Management

The combined enterprise is led by two key figures: CEO Jenilee Common, formerly of Erie Home, and President and COO Rocco Mango from Leaf Home. Their joint experience in managing multi-million dollar operations and dealing with subtle parts of the home remodeling industry is set to drive the new entity to even greater heights.

Key leadership highlights include:

- Jenilee Common: With over 20 years of executive experience at large industrial companies and a proven track record in strategy and supply chain efficiency, Common has a clear vision for harnessing the strengths of both legacy operations. Her leadership is expected to anchor the company’s long-term strategy with disciplined growth and operational excellence.

- Rocco Mango: Having already steered Leaf Home to substantial growth as COO, Mango’s deep operational know-how is one of the driving forces behind the company’s ability to handle expanding geographic reach and multiple service lines. His role as President and COO in the new organization will continue to ensure that operational performance remains at the forefront.

The appointment of these leaders reflects a broader trend in strategic mergers, where continuity and established expertise are key to securing the trust of customers and investors alike. Their combined expertise makes it possible to overcome the difficult bits that arise from merging complex data systems, culture, and operational practices.

Insights on Industry Consolidation and Competitive Advantage

The decision to merge reflects a strategic response to the highly competitive and evolving landscape of residential home services. Industry consolidation is a trend that has been steadily gaining momentum as companies look to combine strengths, share best practices, and overcome the overwhelming parts associated with scale and expansion.

Some observations on consolidation include:

- Market Confidence: Consolidation sends a positive signal to the market that the company is not only growing but also capable of managing multiple facets of home improvement in a consolidated manner.

- Operational Synergies: Coordinating two complementary service ranges—from roofing to remodeling—provides a more comprehensive offering to consumers. This comprehensive product suite helps in creating a one-stop shop that manages every step of the home improvement journey.

- Efficiency Gains: By pooling resources, the new company can streamline operations, lower costs, and improve efficiencies. Such benefits are critical in a sector characterized by tricky parts such as local compliance, talent management, and supply chain challenges.

Overall, the merger is a case study in how strategic consolidation, when done thoughtfully, can transform companies from regional players into a national powerhouse. It is a model that other industries might consider when facing similar twists and turns in their respective markets.

Addressing the Overwhelming Aspects: Operational and Cultural Integration

Merging two large service providers is never straightforward. The process of integrating different cultures, operational systems, and management practices can be intimidating. However, there are several methods companies can use to get around these tricky parts and ensure a smooth transition.

Effective integration often involves:

- Clear Communication: Regular, transparent updates can help both teams understand the vision and their place in the new structure. This clarity is key when dealing with subtle parts of cultural and operational adjustments.

- Standardized Processes: By creating clear, standardized operating procedures, the company can figure a path through the maze of local practices and regulatory requirements.

- Mutual respect and synergy: Emphasizing teamwork and the benefits of shared expertise helps alleviate the nerve-racking aspects of merging two unique cultures.

Many companies that have undergone similar mergers have found that investing time and resources in these hidden complexities ultimately pays off in smoother operations and better customer experiences. The integration efforts at Leaf Home and Erie Home set an example for other firms grappling with similar challenges.

Opportunities and Growth Potential in Direct-to-Consumer Home Services

The unified business is uniquely positioned to harness the growth potential that arises from the booming direct-to-consumer marketplace. Homeowners today look for seamless experiences, quick responses, and tailored solutions to improve and protect their living spaces. The merger not only answers these consumer demands but also provides a platform for future innovation and growth.

Key growth opportunities include:

- Expansion into New Markets: With an expanded geographical network, the company can now target underserved regions while reinforcing its presence in established markets.

- Technological Integration: As digital tools continue to evolve, the company can invest in advanced customer relationship management systems and data analytics to offer personalized service recommendations.

- Cross-Selling and Upselling: With a wider product portfolio, sales teams have the chance to provide comprehensive package deals that include multiple home services, enhancing customer loyalty and boosting average transaction values.

As the business moves forward, it will be interesting to see how the combined entity leverages these opportunities while managing its way through the unpredictable aspects of market dynamics and consumer expectations.

Implications for Small Businesses and Industrial Operations

The merger’s broader implications reach beyond the home services sector and offer valuable lessons for small businesses and industrial manufacturers alike. A well-executed consolidation can serve as a blueprint for how businesses in other sectors might address the challenges of scale, operational inefficiency, and stale market approaches.

Important takeaways include:

- Resilience in Tough Markets: Small businesses can learn from the structured approach in financing and leadership that mitigates the overwhelming parts of market volatility.

- Operational Excellence: Investing in robust operational processes and standardized procedures is essential for managing the tricky parts of expansion.

- Customer-Centric Strategies: Focusing on direct-to-consumer outreach, quality service, and building trust are strategies that can be emulated by companies of all sizes.

These insights underline the importance of strategic planning, innovative thinking, and a commitment to quality service. Small business owners and industrial companies alike can look to this merger as a model for how to combine growth with operational stability, even when faced with the tangled issues of integrating different business models.

Lessons Learned: Steering Through the Confusing Bits

No merger is without its nerve-racking challenges. As the new company embarks on this ambitious journey, there are several lessons to glean from the process so far. The strategies employed by Leaf Home and Erie Home offer a roadmap for other companies looking to figure a path through similar twists and turns.

Core lessons include:

- Strategic Financing Matters: Backing from heavyweights like Ares Management and Apollo demonstrates the importance of securing diverse and reliable sources of capital, especially when facing the complicated pieces related to operational scale.

- Leadership is Key: The combined expertise of seasoned leaders reassures investors and employees that the company is prepared to tackle both the exciting opportunities and the daunting integration challenges.

- Cultural Integration: Merging different corporate cultures requires tact, patience, and a shared vision. Investing time into aligning teams is a critical step that pays off once the dust settles.

These lessons serve as a reminder that while the merger may be loaded with issues in its early days, a clear strategy and committed leadership can effectively steer through even the most confusing bits.

Innovative Financial Instruments Driving the Merger

The structure of modern mergers often involves a combination of preferred equity and debt financing – a marriage of financial instruments that supports continued growth without compromising operational autonomy. In this case, notable players like Ares Management and Apollo have shown how to support a merger while buffering against the nerve-racking financial volatility that can accompany rapid expansion.

By employing such instruments, the merger achieves several financial benefits:

| Financial Instrument | Advantages | Role in the Merger |

|---|---|---|

| Preferred Equity Investment |

|

Provided by Ares Management to support strategic growth and facilitate key add-on acquisitions. |

| Debt Financing |

|

Offered by Apollo, ensuring that the company can invest in operational expansion and technology integration. |

This blend of financing not only safeguards the company through potentially intimidating financial cycles but also reinforces investor confidence—a critical message for stakeholders who rely on clarity and calculated risk management.

Consumer Trust and Brand Value in the Age of Home Services

At the end of the day, the most critical element in any residential service business is consumer trust. For homeowners, the decision to invest in major home improvements or regular maintenance hinges on the reputation of the service provider. The merger creates a brand that is super important in today’s market—a brand known not just for scale, but for the quality and reliability of its service packages.

Building consumer trust involves:

- Quality Assurance: Consistent delivery of high-quality services in varied environments builds a strong reputation. The merger combines expertise from both preceding companies to ensure consistent quality.

- Clear Communication: Regular, open dialogue with customers about service improvements and operational changes helps to ease concerns during the transition period.

- Comprehensive Service Offerings: A one-stop-shop for homeowners looking for everything from roofing to remodeling creates an image of reliability, helping to foster deep-seated consumer confidence.

Over time, such brand strength can lead to repeat business and enhanced customer lifetime value, making the combined entity a model for how quality service and expanded offerings can secure a competitive advantage.

Economic Impacts and Trends in the Home Services Sector

In light of the current economic environment, the merger is particularly noteworthy due to its timely response to emerging trends in the home services sector. With rising consumer expectations and a competitive market landscape, companies are continually forced to adapt to new economic realities. The following factors illustrate why this merger is both a response to and a catalyst for broader economic changes:

- Changing Demand Patterns: As homeowners seek value and quality, businesses that can deliver a comprehensive suite of services are naturally positioned to capture market share.

- Cyclical Economic Pressures: Economic fluctuations often lead to mixed consumer spending patterns where efficiency and reliability become crucial buying factors.

- Investment in Innovation: Facing nerve-racking economic uncertainties, companies are increasingly investing in technology and operational improvements to create sustainable growth and maintain market dominance.

This dynamic environment necessitates companies that are agile, well-capitalized, and adept at managing the small distinctions in consumer expectations. The combined company’s response to these trends—through strategic financing, leadership expertise, and service diversification—serves as a blueprint for how firms might respond to economic pressures.

Small Business Lessons from a Major Industry Merger

While the merger of Leaf Home and Erie Home is large-scale and draws considerable attention from industry analysts, it also has important implications for small businesses. Many small business owners are eager to get into the nitty-gritty of how a successful merger can translate into a competitive edge and sustainable growth on a smaller scale.

Insights for small businesses include:

- Strategic Investment: Small businesses should consider how partnering or merging with complementary services can provide mutual benefits and mitigate the nerve-racking challenges of market competition.

- Operational Integration: Streamlining operations through technology and standardized processes helps in managing the confusing bits that come with scaling up.

- Consumer Focus: Prioritizing quality, responsiveness, and clear communication can bridge the gap between small localized services and larger, centralized operations.

These lessons serve as a reminder that whether you’re a multi-state company or a single-location business, the underlying principles of strategic growth, quality service, and strong leadership hold true. In today’s dynamic market, small businesses that adopt these principles can enhance their chance of success even when faced with rival giants.

Industry Perspectives: A Look from Financial and Strategic Advisors

Financial and strategic advisors have been quick to weigh in on this merger, noting both the challenges and the promise that such a consolidation holds for the sector. Experts remark that the smart mix of preferred equity and debt financing—as well as the leadership team’s deep experience—are critical for ensuring the long-term value of such transactions.

Some highlighted perspectives include:

- Financial Confidence: With major investors like Ares Management and Apollo involved, there is a strong message that the company is built on a solid financial foundation—a critical factor especially when making your way through economic uncertainties.

- Strategic Fit: Industry experts view the merger as a well-calculated move that not only increases market presence but also delivers improved operational efficiency, addressing many of the complicated pieces associated with integration.

- Future Growth Outlook: Observers are optimistic that the combined entity will continue to generate growth through both organic development and additional strategic acquisitions. This outlook is reinforced by the increasing demand for direct-to-consumer home services.

These expert insights underline that while the road ahead might feature a few tough turns, the strategic vision evidenced by the merger clearly points to a promising future for the home services industry.

Conclusion: Building a Trusted Home Services Empire Amid Economic Challenges

The merger between Leaf Home and Erie Home is more than a simple business transaction—it symbolizes a new era in the residential home services industry. By combining strengths, expanding service offerings, and confidently tackling both operational and financial challenges, the new entity sets a high benchmark for other companies in the sector.

This transformation is reflective of a broader trend where businesses are increasingly focusing on comprehensive, direct-to-consumer solutions that build trust and deliver operational excellence. In an industry riddled with tension and loaded with mixing traditional practices with innovative approaches, this merger emerges as an example of how to figure a path through both exciting opportunities and nerve-racking challenges.

For homeowners, the benefits are clear: a single, reliable source capable of delivering a wide array of high-quality home services. For investors and industry stakeholders, the merger represents a calculated response to market dynamics—one that combines financial strength, strategic leadership, and a commitment to operational excellence.

As the newly unified company embarks on its journey, it is set to redefine what it means to be a trusted home services provider in the 21st century. The challenges that lie ahead, while intimidating at times, are met head-on with a vision that is super important to both its employees and customers. This merger teaches us that, when done right, blending businesses can create not just scale and efficiency, but also immeasurable value through enhanced customer service and innovative market approaches.

In reflecting on the lessons from this industry-defining merger, businesses of all sizes can take note: success in today’s fast-evolving marketplace comes from the ability to merge operational expertise with clear strategic vision, and an unwavering focus on customer satisfaction. The combination of Leaf Home and Erie Home stands as a powerful example of how unity, backed by solid financing and experienced leadership, can create a home services empire that is ready to face the future—confidently delivering peace of mind, one homeowner at a time.

Originally Post From https://peprofessional.com/2025/09/leaf-home-acquires-erie-home-to-broaden-north-american-residential-services-platform/

Read more about this topic at

Residential Services Market: Perspectives and Trends

Home Internet, TV, Phone and Security Service Provider